Introduction

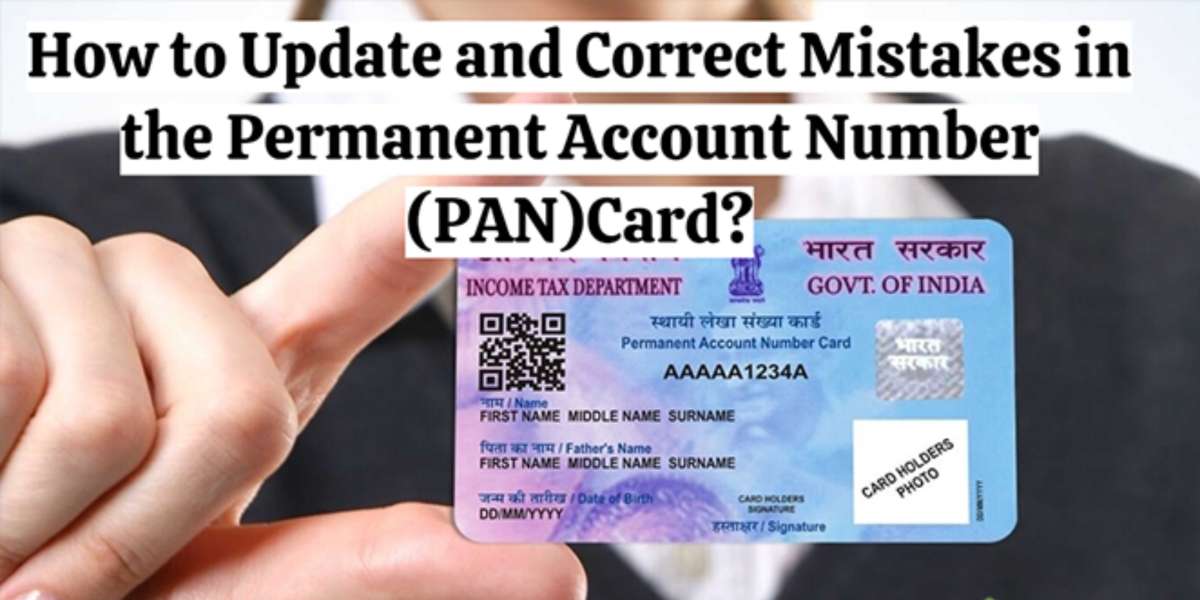

If you have filed for a PAN card and there are some mistakes in it, then you can rectify them. There are many ways to do this. You can visit the Income Tax Department website or call their helpline number and get help from them.

Mistakes can happen when one files the PAN application.

Mistakes can happen when one files the PAN application. Errors can be corrected in the PAN card, but not all types of errors are possible to correct. The following are some common mistakes:

Failure to fill-in all blanks on a form or page (e.g., incorrect name, incomplete address)

Failing to sign and date at least one part of your form/page (e.g., missing signature)

Missing any field(s) from your form/page

The mistakes or errors can be corrected.

The mistakes or errors can be corrected.

The errors in the PAN card are:

Serial number mismatch, when the serial number does not match with the one on record in your bank or any other agency that issued PAN card to you. You need to contact them and they will rectify this error at their end by issuing new ones for both cards.

Wrong address/name, if there is a wrong address/name mentioned in your application form; it must be corrected immediately so that no further delays occur due to such issues later on during tax filing season when taxes need to be paid by everyone who files his income tax returns every year (as per law).

The following errors can be corrected in the PAN card.

The following errors can be corrected in the PAN card.

The PAN card is issued to a wrong person.

A minor has been issued with a PAN card, but they do not need one as they are not allowed to apply for it and get their own income tax returns filed by themselves. You must submit an affidavit of majority along with your application, so that you can apply for a new one if needed.

An NRI or foreign national has been issued with your personal information on his/her passport, even though he/she does not have any documents proving that he/she is an Indian citizen yet (like an Aadhaar number), so please make sure before submitting any documents related to opening an account under section 139AA of Income Tax Act 1961).

How to change or correct corrections in your PAN Card online?

PAN card correction is a simple process, and you can change your PAN card online. You can correct errors in the PAN card by following these steps:

Log into your e-mail account on the website of the Income Tax Department or visit their official website at http://www.incometaxindiaefiling.gov.in/pnc/.

Once logged in, click on 'Online Services' from the bottom left corner of your screen and select 'Change/Correction'.

Select whether you want to change any details such as address or name etc., then enter them accordingly (e-mail address for changing your address). To do so, follow these steps: 1) Type in your old address (if available), 2) Click "Save" button which will display next window where it says "Your new residential address has been submitted successfully", 3) Write down new residential address that has been submitted by filling out relevant fields such as street number/name etc., 4) Click "Submit".

Errors in the PAN card can be rectified.

If you have a mistake in your PAN card and want to rectify it, you can do so by following these steps:

Login to the e-filing website of the Income Tax Department (http://incometaxindiaefiling.gov.in/)

Enter your login details and password; log in using your fingerprint recognition device.

Conclusion

The PAN card is a crucial document that serves as proof of identity and residence. It can be used to access a range of services, including banking, transport, phone and electricity bills. The PAN card error rectification process involves applying for the correction online or visiting your nearest departmental office with your original documents along with photocopies of the documents. In case you do not have access to a computer or Internet connection, you can call us at 1800-110-9000 for assistance